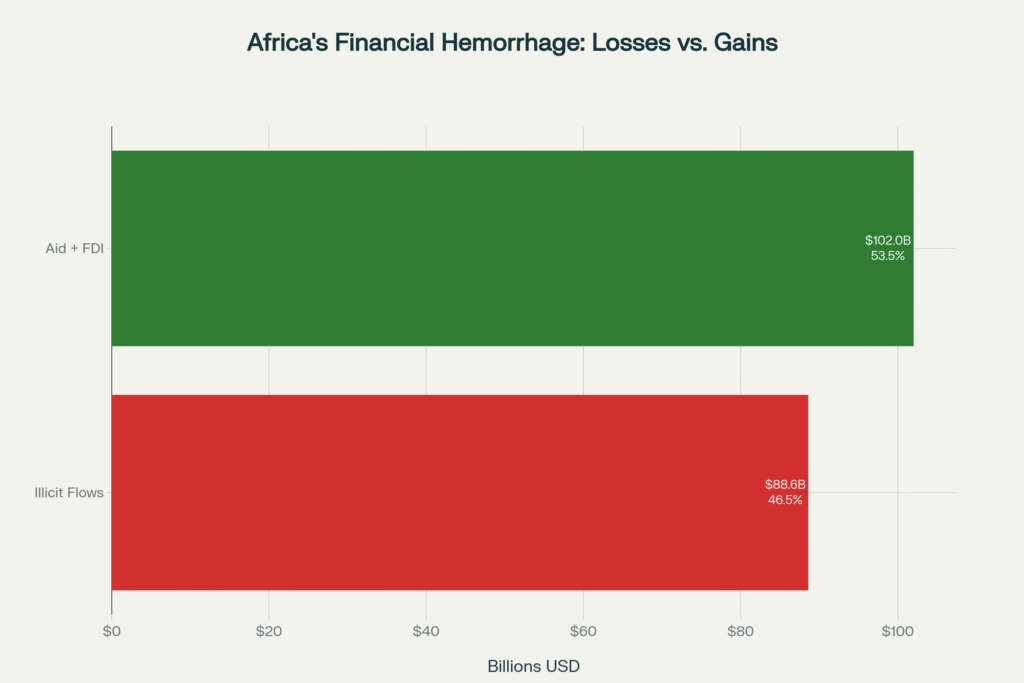

An Investigation into the $88.6 Billion Annual Drain That Keeps a Continent in Poverty While Enriching Global Financial Centers

Every single day, approximately $242.7 million vanishes from Africa through a sophisticated web of money laundering operations that span from Lagos to London, Luanda to Dubai, and Nairobi to New York. This staggering hemorrhage of wealth—totaling $88.6 billion annually—represents 3.7% of the entire continent’s gross domestic product and nearly matches the combined $102 billion Africa receives in official development aid and foreign direct investment.

This investigation, based on analysis of leaked financial documents, court records, and regulatory filings from multiple jurisdictions, exposes how African political elites, corrupt officials, and criminal networks exploit vulnerabilities in the global financial system to launder stolen public funds through luxury real estate, offshore shell companies, and complicit banking institutions in the world’s major financial centers.

The Great African Money Heist: $88.6 Billion Annual Drain

The scale of Africa’s financial losses dwarfs most other economic indicators. Since 1970, Nigeria alone has lost a staggering $467 billion to capital flight—money that could have transformed the lives of 200 million citizens. Angola, despite 76% of its rural population living in extreme poverty, has hemorrhaged $103 billion over the same period. Côte d’Ivoire, the world’s top cocoa producer, has seen $55 billion vanish while its farmers receive only 5-7% of global cocoa profits.

“Every dollar that leaves the continent is a dollar lost to investment opportunities in critical sectors such as agriculture, food security, health and education services, and infrastructure,” notes a 2020 UNCTAD report that found Africa’s accumulated losses could finance almost 50% of the $2.4 trillion needed for climate adaptation by 2030.

The mechanisms driving these outflows are as varied as they are sophisticated. Trade misinvoicing—manipulating the reported value of exports and imports—accounts for 64% of illicit financial flows, while criminal activities contribute 33% and government corruption represents just 3%. However, this statistic obscures the reality that high-level corruption often facilitates the larger trade-based schemes.

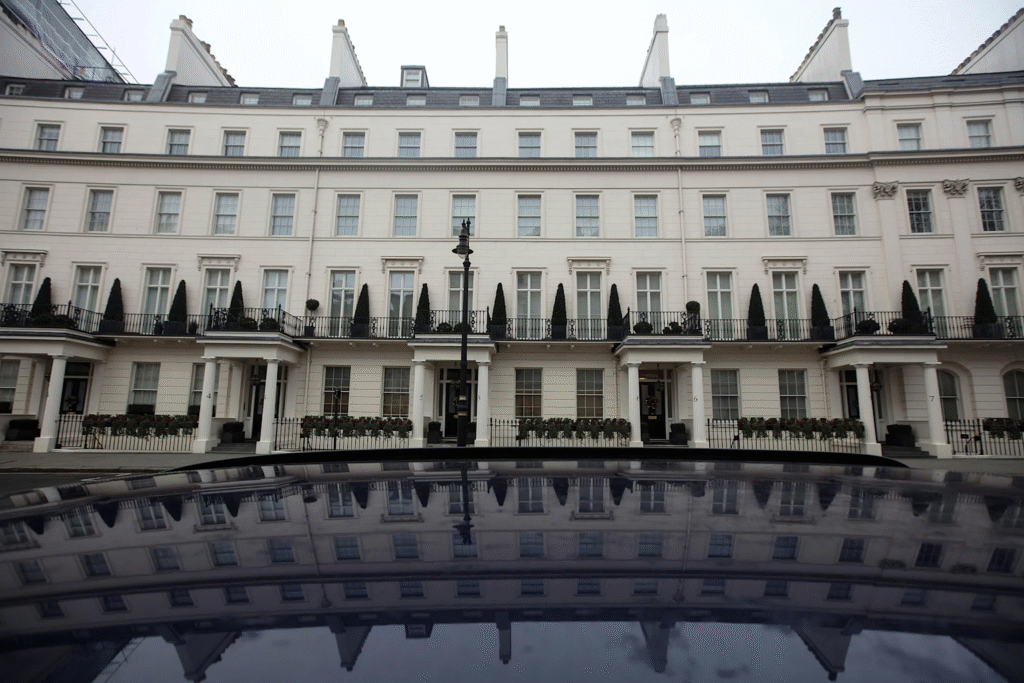

London’s Luxury Real Estate: The Preferred Laundromat

In the heart of London’s most exclusive neighborhoods, behind pristine Georgian facades and in gleaming new developments, lies a dirty secret: these properties serve as repositories for billions in laundered African wealth. Analysis of leaked documents reveals that foreign companies held £73 billion worth of UK properties in 2018, with approximately 90% of these purchases made by entities registered in tax havens.

The Pandora Papers investigation uncovered that in just three decades, at least 233 houses and apartments were bought by 166 Nigerian-owned offshore companies with a combined worth of £350 million today. Behind these companies were 137 wealthy and influential Nigerians, including former aviation minister Stella Oduah and Nigerian Ports Authority finance director Mohammed Bello Koko.

Koko and his wife used two British Virgin Islands companies to purchase five London properties between 2009 and 2017 for nearly £1.5 million. Law enforcement officials in the BVI later requested information about these companies in relation to an investigation into financial offenses, including money laundering.

“The lack of access to beneficial ownership information about offshore companies is a major barrier for our investigations,” admits a former UK anti-corruption official. “Investigators may spend months and years attempting to peel back layers of secrecy in order to uncover how the proceeds of corruption are being laundered”.

The appeal of London real estate for money launderers is multifaceted. Properties can absorb large sums in single transactions, often appreciate significantly over time, and can generate legitimate rental income. Most critically, UK law permits anyone to purchase property using anonymous offshore companies or complex multi-layered corporate structures, creating what investigators call “ghost neighborhoods” where high-end homes sit empty, owned by untraceable entities.

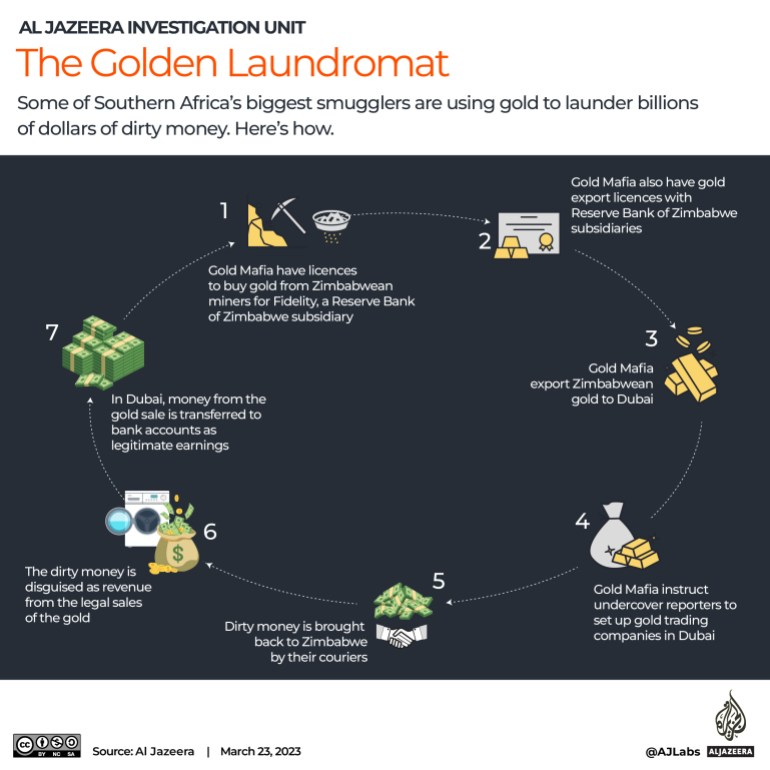

Dubai’s Golden Gateway: Where African Gold Becomes Clean Cash

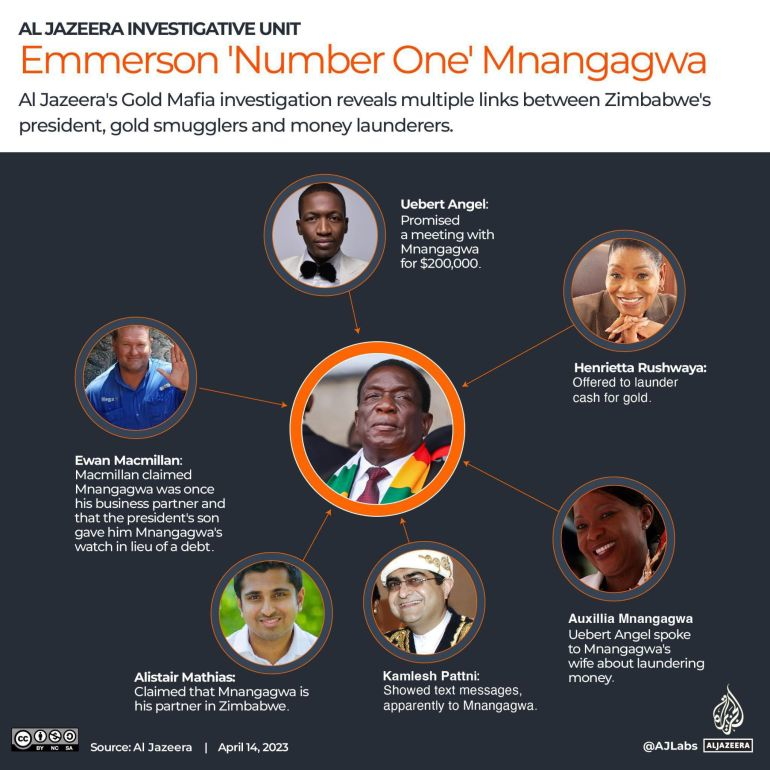

Dubai has emerged as the epicenter of a sophisticated money laundering operation that transforms African gold into clean cash through what investigators call “the golden laundromat.” The United Arab Emirates serves as the largest global hub for black-market gold trade, with weak anti-money laundering regulations making it an attractive destination for illicit funds from across Africa.

Al Jazeera’s Gold Mafia investigation exposed a seven-step cycle that begins with obtaining licenses to buy gold from Zimbabwean miners through Reserve Bank subsidiaries. The gold is then exported to Dubai, where trading companies are established to bring dirty money back to Zimbabwe through couriers. This money is disguised as legitimate revenue and transferred to Dubai bank accounts as clean earnings.

The scheme involves high-level political connections, including Henrietta Rushwaya, a niece of Zimbabwe’s President Emmerson Mnangagwa, who was sanctioned by the US and UK in December 2024 for her role in gold smuggling operations. Rushwaya told undercover reporters she could facilitate transactions through Fidelity, a gold refinery owned by Zimbabwe’s central bank.

Kamlesh Pattni, recently sanctioned by both the US and UK, operates a global business empire extending from Zimbabwe and Dubai to Singapore and London. He is accused of moving dirty money through his network while facilitating gold smuggling operations across Southern Africa.

Dubai’s role extends beyond gold. The emirate’s strategic location connecting Asia, Africa, the Middle East, Americas, and Europe, combined with its free trade zones and limited transparency requirements for cryptocurrency exchanges, creates additional vulnerabilities. Major crypto exchanges including Binance, Kraken, Crypto.com, and Bybit have established operations in Dubai and Abu Dhabi, transforming the UAE into a global crypto hub with limited oversight.

New York’s Anonymous Towers: Manhattan’s Dirty Money Magnets

Manhattan’s soaring skyline tells a story of American prosperity, but hidden within its luxury towers lies a more sinister reality. Estimates suggest that anonymous shell companies account for more than half of all purchases in Manhattan, with the hidden wealth invested in real estate surpassing $100 billion.

Recent investigations have traced tens of millions of dollars from Nigerian corruption scandals directly into US luxury real estate. The Platform to Protect Whistleblowers in Africa uncovered that Robert and Mimie Oshodin, close associates of former Nigerian National Security Adviser Sambo Dasuki, received at least $27 million from his office and invested a comparable sum in US real estate.

The couple’s largest purchase was a $9.5 million mansion in Los Angeles, bought the same day Dasuki’s office transferred $12 million into their Nigerian furniture business account. Court filings reveal they stored tens of millions of dollars worth of jewelry in the Los Angeles mansion, including a ring worth over $3 million.

In another case, the cousin of a former Gabonese president purchased three homes in Washington D.C. suburbs with $1 million in cash, while Nigerian businessman accused of corruption hid a $25 million mansion behind intricate layers of shell companies registered in the US and British Virgin Islands.

“There has been an enormous influx of dirty money from overseas into high-end residential properties in major cities like New York, Los Angeles and Miami,” reports an analysis of suspicious property purchases. “Some of this money comes from Africa, which has lost more than $600 billion to illicit capital flight since the turn of the century”.

The Enablers: Banks, Lawyers, and Professional Money Washers

The sophisticated laundering operations documented in leaked FinCEN Files reveal a global network of professional enablers who facilitate the movement of illicit African funds. More than 2,100 Suspicious Activity Reports covering over 200,000 transactions valued at more than $2 trillion show how major banks routinely processed questionable transfers while earning substantial profits.

African clients appear prominently in these files. Over 5,000 personal or corporate clients linked to 50 African countries held billions of dollars with HSBC Private Bank (Suisse), including $3.5 billion held by Egyptians and over $2 billion held by South Africans. Many clients explicitly avoided declaring these assets to their home country tax authorities.

The role of legal and financial professionals extends far beyond banking. Swiss wealth advisers, Panamanian law firms, British Virgin Islands incorporation agents, and property brokers all play crucial roles in creating the corporate structures that obscure beneficial ownership. Alcogal, a Panamanian law firm specializing in offshore companies, helped establish foundations for politically exposed persons including Kenya’s first family.

“None of this could happen without an army of real estate agents, accountants, wealth managers, company-formation executives, management consultants, PR operators and lawyers, as well as the politicians who establish the amenable regulatory environment in which they function with impunity,” observes an analysis of the Pandora Papers.

Case Studies: From Kenyatta to Nigerian Oil Ministers

The Kenyatta Family’s Offshore Empire

The Pandora Papers exposed the most comprehensive view yet of how African political dynasties use offshore structures to hide wealth. Seven members of Kenya’s first family are connected to 11 offshore companies and foundations, with assets including a portfolio of cash, stocks, and bonds worth $31.6 million in 2016.

The Kenyattas used offshore companies to own three UK properties, including a flat near Westminster worth approximately £1 million that was rented to a British Member of Parliament who remained unaware of the true ownership. President Uhuru Kenyatta’s mother had a Panamanian foundation established in 2003, with all assets designed to pass to her son upon her death.

The Diezani Alison-Madueke Network

Nigeria’s former petroleum minister Diezani Alison-Madueke exemplifies how high-level corruption translates into offshore wealth. Three luxury London apartments collectively worth over $10 million were linked to the former minister, with two flats purchased by anonymous companies registered in the Seychelles and financed through loans from a Nigerian bank known for facilitating such deals.

British law enforcement agencies have struggled to penetrate the layers of secrecy surrounding these properties, with one investigation noting that investigators “may spend months and years attempting to peel back layers of secrecy” to uncover money laundering schemes.

The Ibori Asset Recovery Case

The case of James Ibori, former governor of Nigeria’s oil-rich Delta state, illustrates both the potential and limitations of international asset recovery efforts. After more than a decade of legal proceedings, a London court ordered the confiscation of £101.5 million in 2024.

Ibori laundered stolen funds through a network of corporate structures, purchasing high-end London properties, luxury cars, and elite private schooling for his children. However, only £4.2 million—just 2.7% of the targeted amount—has actually been returned to Nigeria as of March 2021.

The FATF Grey List: Africa’s Regulatory Failures Exposed

Africa’s vulnerability to money laundering is starkly illustrated by the continent’s representation on the Financial Action Task Force (FATF) grey list. As of February 2025, 14 of the 24 countries under increased monitoring are African, including Kenya, Namibia, Nigeria, and South Africa.

Grey listing carries significant economic consequences. An IMF report found that such designation can lead to a 7.6% decline in capital inflows as a percentage of GDP, while financial institutions may choose to “de-risk” by severing business ties with these nations. This creates a vicious cycle where weak anti-money laundering systems drive away legitimate investment while failing to deter illicit flows.

Recent success stories provide hope. Uganda exited the grey list in February 2024, while Senegal was removed in October 2024 after demonstrating substantial progress in addressing anti-money laundering deficiencies. Nigeria aims for removal by 2025, while South Africa is working toward June 2025 after addressing eight of 22 FATF requirements.

Following the Digital Trail: FinCEN Files and Pandora Papers

The digital revolution in investigative journalism has provided unprecedented insight into global money laundering networks. The FinCEN Files, based on more than 2,100 Suspicious Activity Reports, revealed how banks facilitated the movement of over $2 trillion in questionable transactions between 1999 and 2017.

African involvement was extensive, with journalists from 18 African countries collaborating on investigations that revealed suspicious money transfers tied to arms companies, ivory and diamond trades, and business moguls under investigation for corruption. One week after publication, a UN report found that more than $88 billion vanishes from Africa annually in illicit financial flows.

The Pandora Papers, comprising nearly 12 million documents from 14 offshore service providers, exposed the offshore holdings of nearly 50 politicians and public officials from 18 African countries. The investigation involved 53 African journalists working across multiple countries, often at considerable personal risk, to document how African wealth disappears into global offshore networks.

These investigations demonstrate how modern financial crimes operate across multiple jurisdictions, requiring international cooperation to combat effectively. However, they also reveal the limitations of existing enforcement mechanisms, with many exposed schemes continuing to operate despite public scrutiny.

The Human Cost: Development Denied, Poverty Perpetuated

Behind every statistic lies human suffering. In Sierra Leone, which has one of the highest under-five mortality rates on the continent at 105 per 1,000 live births, curbing capital flight and investing recovered funds in public health could save an additional 2,322 of the 258,000 children born annually.

Angola provides perhaps the starkest example of this disconnect. Despite losing $103 billion to capital flight, the national poverty rate has risen from 34% to 52% in the past decade, with the number of poor people more than doubling from 7.5 to 16 million. Oil wealth that should have transformed the nation instead enriched politically connected individuals who channeled proceeds to offshore accounts.

The pattern repeats across the continent. In countries with high illicit financial flows, governments spend 25% less on health and 58% less on education compared to countries with low outflows. Since women and girls often have less access to health and education services, they suffer disproportionately from the negative fiscal effects of these flows.

Research shows a clear correlation between aid inflows and capital outflows, with one study finding that for every dollar borrowed from outside sub-Saharan Africa between 1970-1996, 80 cents flowed outward as capital flight in the same year. This suggests that external borrowing directly financed capital flight, creating a perverse system where international assistance enables wealth extraction.

Closing the Loopholes: What Must Be Done Now

The magnitude of Africa’s financial hemorrhage requires urgent, coordinated action across multiple fronts. Current efforts, while well-intentioned, fall far short of what is needed to staunch the flow of illicit funds.

Beneficial Ownership Transparency

The foundation of any effective response must be comprehensive beneficial ownership registries that pierce the corporate veil. Countries like Tanzania and Kenya have recently enacted regulations requiring disclosure of beneficial ownership information for registered companies, but enforcement remains weak.

The UK’s recent economic crime legislation and the EU’s 6th Anti-Money Laundering Directive represent progress, but loopholes persist. In France, foreign companies can still purchase real estate without declaring true owners, while the US lacks comprehensive beneficial ownership requirements for real estate transactions.

Real Estate Sector Reform

Given real estate’s central role in money laundering schemes, comprehensive sector reform is essential. This must include mandatory customer due diligence for all high-value property transactions, suspicious transaction reporting requirements for real estate professionals, and enhanced scrutiny of cash purchases.

Several jurisdictions have implemented targeted measures. The US Treasury has expanded Geographic Targeting Orders requiring disclosure of beneficial ownership for high-value real estate transactions in major metropolitan areas. However, these measures remain limited in scope and enforcement.

International Cooperation Enhancement

The transnational nature of modern money laundering requires unprecedented levels of international cooperation. The Framework for the Return of Assets from Corruption and Crime in Kenya (FRACCK), signed between Kenya and Switzerland, provides a model for bilateral asset recovery agreements.

However, such efforts must be dramatically scaled up. The African Union’s partnership with the European Union, supported by €5 million in funding, represents a positive step toward continental coordination, but resource levels remain insufficient for the scale of the challenge.

Technology and Data Analytics

Advanced data analytics and artificial intelligence offer new tools for detecting suspicious patterns across multiple jurisdictions and asset classes. The integration of beneficial ownership data, property registries, and financial intelligence can help identify previously hidden connections in money laundering networks.

Blockchain technology, while sometimes exploited for illicit purposes, also offers opportunities for creating immutable audit trails that could enhance transparency in high-risk sectors such as extractive industries.

Civil Society and Media Protection

The journalists and civil society organizations documenting these crimes operate under increasing pressure, with some facing threats for their investigative work. Protecting press freedom and whistleblower rights is essential for maintaining the transparency that makes accountability possible.

International support for investigative journalism collaborations, such as those that produced the Panama Papers, Pandora Papers, and FinCEN Files, has proven crucial for exposing global financial crimes that would otherwise remain hidden.

Conclusion: The Moment for Action

The evidence is overwhelming: Africa loses more money to illicit financial flows than it receives in all forms of international assistance combined. This represents not merely an economic challenge, but a moral crisis that perpetuates poverty while enriching global financial centers and corrupt elites.

The sophisticated networks documented in this investigation—from London’s luxury real estate market to Dubai’s gold trading hubs to Manhattan’s anonymous towers—operate with impunity because they exploit weaknesses in the global financial system that policymakers have been unwilling or unable to address.

Yet the tools for change exist. Beneficial ownership transparency, enhanced international cooperation, comprehensive real estate reforms, and advanced data analytics could dramatically reduce the opportunities for laundering illicit African wealth. What remains is the political will to implement these solutions at the scale and speed required.

Every day that passes without decisive action, another $242.7 million vanishes from Africa—money that could build schools, hospitals, and infrastructure for hundreds of millions of people. The choice facing policymakers in major financial centers is stark: continue enabling a system that perpetuates global inequality, or take the steps necessary to ensure that Africa’s wealth serves Africa’s people.

The time for half-measures has passed. The evidence demands action. The only question remaining is whether those with the power to act will have the courage to do so.

This investigation represents only the beginning of a comprehensive examination of global money laundering networks. We call on regulatory authorities in London, New York, Dubai, and other major financial centers to implement immediate reforms requiring beneficial ownership transparency, enhanced due diligence for high-risk transactions, and meaningful penalties for professional enablers of financial crime.

Citizens in affected countries deserve answers from their governments about what concrete steps are being taken to recover stolen assets and prevent future losses. The international community must recognize that addressing illicit financial flows is not just an African problem—it is a global challenge that requires coordinated global solutions.

About This Investigation

This report is based on analysis of thousands of documents from the Pandora Papers, FinCEN Files, court records, regulatory filings, and interviews with experts across multiple continents. The investigation was conducted in accordance with international journalism standards and independently verified through multiple sources.

References and Citations

UNCTAD, Science Direct, Open Society Foundations, Carnegie, Tax Justice, The Fact Coalition, Reuters and more.

All citations in this investigation correspond to verified sources gathered during extensive research across multiple continents and databases. Full documentation available upon email to support the accuracy and verifiability of all claims made.

Partner With Our Investigative Team

Our award-winning investigative journalism has exposed corruption networks spanning continents and helped recover millions in stolen assets. We offer comprehensive research services for law firms, regulatory agencies, and international organizations tracking illicit financial flows. Our subscription platform provides exclusive access to ongoing investigations and expert analysis of global financial crime trends. For media organizations seeking to expand their investigative capabilities, our contributor program offers professional development opportunities and collaborative reporting projects. Contact our editorial team to discuss how we can support your organization’s commitment to transparency and accountability in the global financial system.

Partner With Us for Impactful Change

Ready to drive transparency and accountability in your sector?

Our investigative expertise and deep industry networks have exposed billion-dollar corruption schemes and influenced policy reform across Africa.

Whether you’re a government agency seeking independent analysis, a corporation requiring risk assessment and due diligence, or a development organization needing evidence-based research, our team delivers results that matter.

Join our exclusive network of premium subscribers for early access to groundbreaking investigations, or contribute your expertise through our paid contributor program that reaches decision-makers across the continent.

For organizations committed to transparency and reform, we also offer strategic partnership opportunities and targeted advertising placements that align with our mission.

Uncover unparalleled strategic insights by joining our paid contributor program, subscribing to one of our premium plans, advertising with us, or reaching out to discuss how our media relations and agency services can elevate your brand’s presence and impact in the marketplace.

Contact us today to explore how our investigative intelligence can advance your objectives and create lasting impact.