In a cramped internet café in Lagos, Nigeria, twenty-three-year-old Emmanuel Adebayo scrolls through his smartphone, executing what appears to be a routine peer-to-peer trade.

While we research and investigate about our cryptocurrency bypass financial regulations Africa story, Emmanuel Adebayo with a few taps, he converts 500,000 naira into Bitcoin, then immediately transfers the digital currency to a contact in Dubai before converting it back to US dollars.

The entire transaction bypasses Nigeria’s banking system, circumvents foreign exchange controls, and leaves no trace in official financial records.

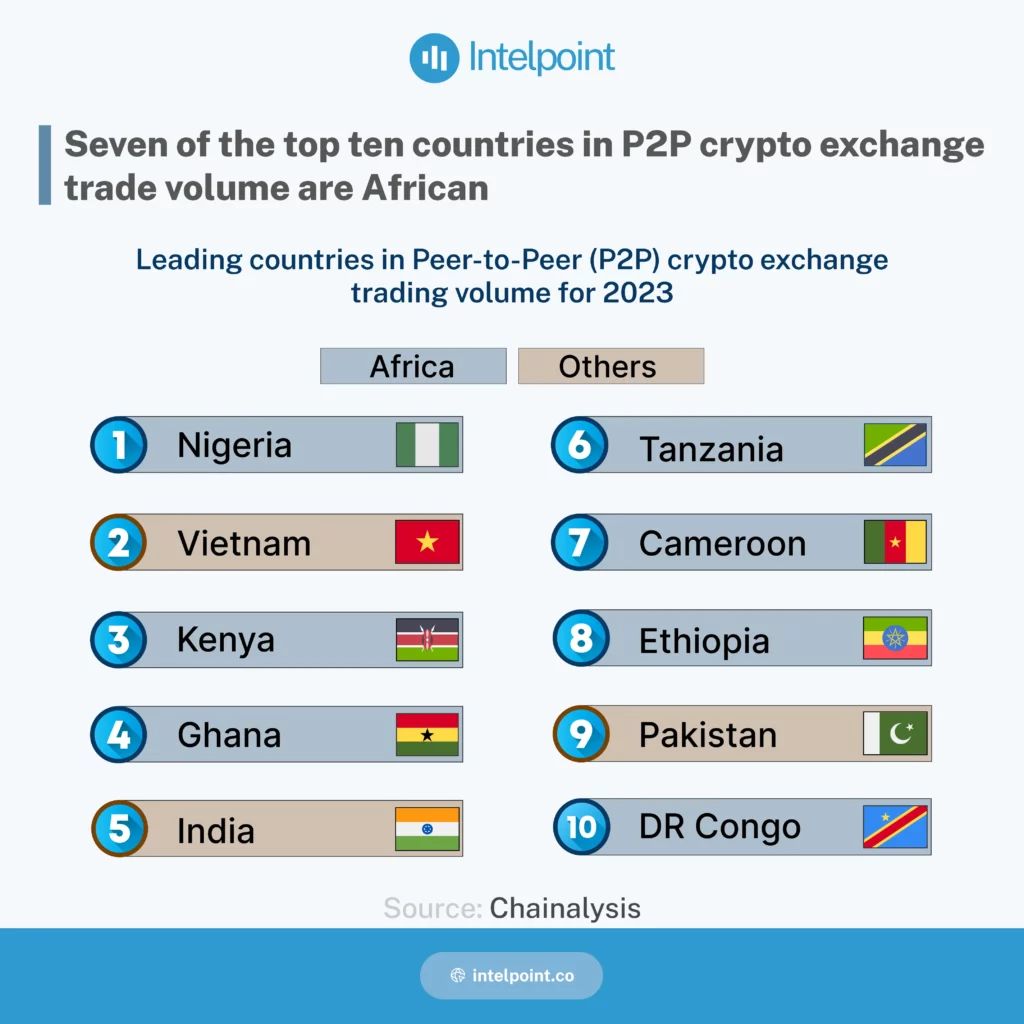

Top ten countries by P2P crypto exchange volume in 2023, showing seven African nations leading the market

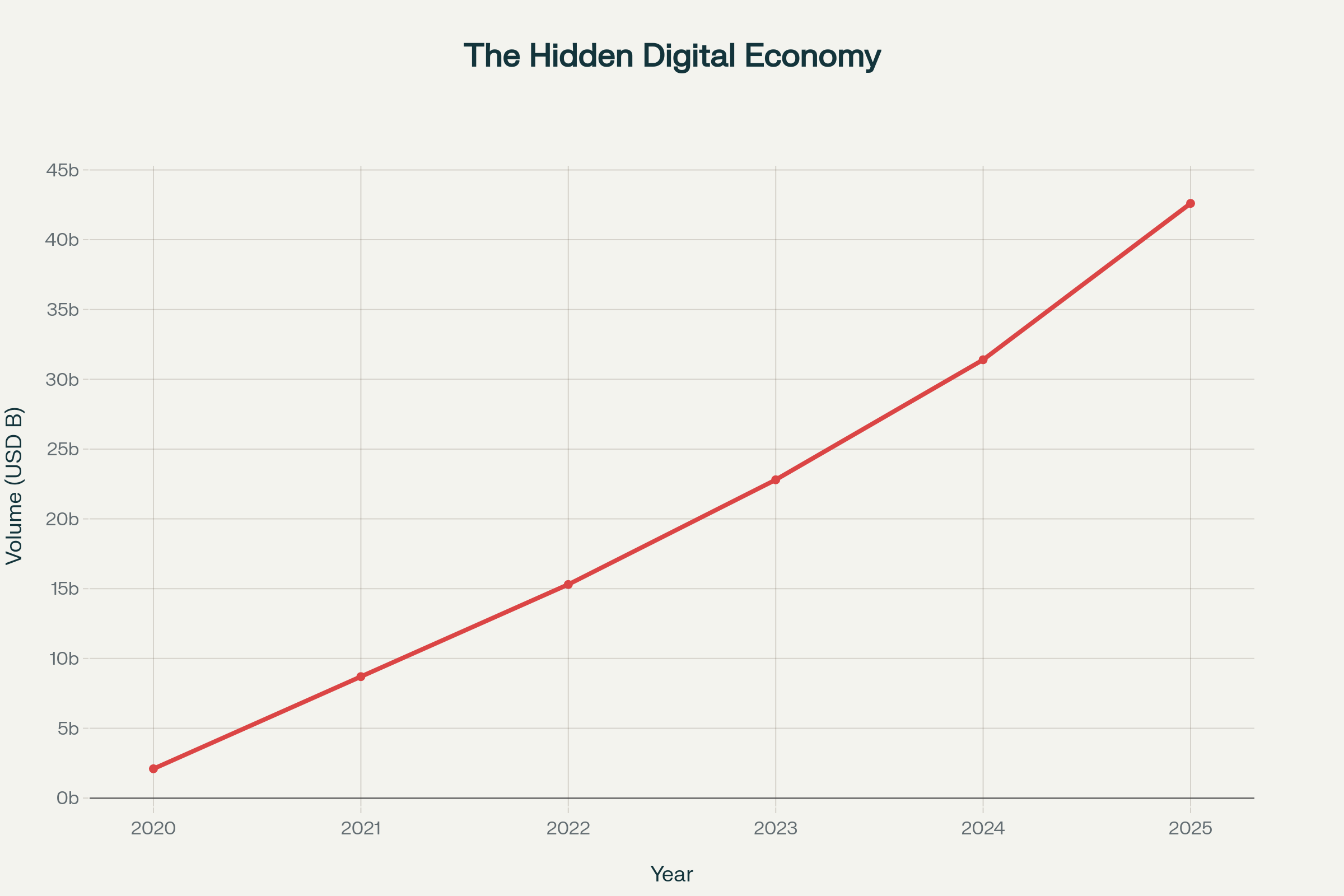

This scene, replicated thousands of times daily across Africa, illustrates how cryptocurrency has evolved from a fringe technology into a sophisticated tool for regulatory evasion. An eight-month investigation reveals that digital currencies are being systematically used to bypass financial regulations across the continent, creating a parallel financial system worth $42.6 billion that operates beyond the reach of traditional oversight mechanisms.

Exponential growth in unregulated cryptocurrency transaction volume across Africa

The Scale of Regulatory Evasion

Africa’s cryptocurrency market has experienced explosive growth, but much of this activity occurs in regulatory shadows. Data from blockchain analytics firm Chainalysis shows that seven of the world’s top ten countries for peer-to-peer cryptocurrency trading are African nations, with Nigeria leading the global rankings despite restrictive banking policies.

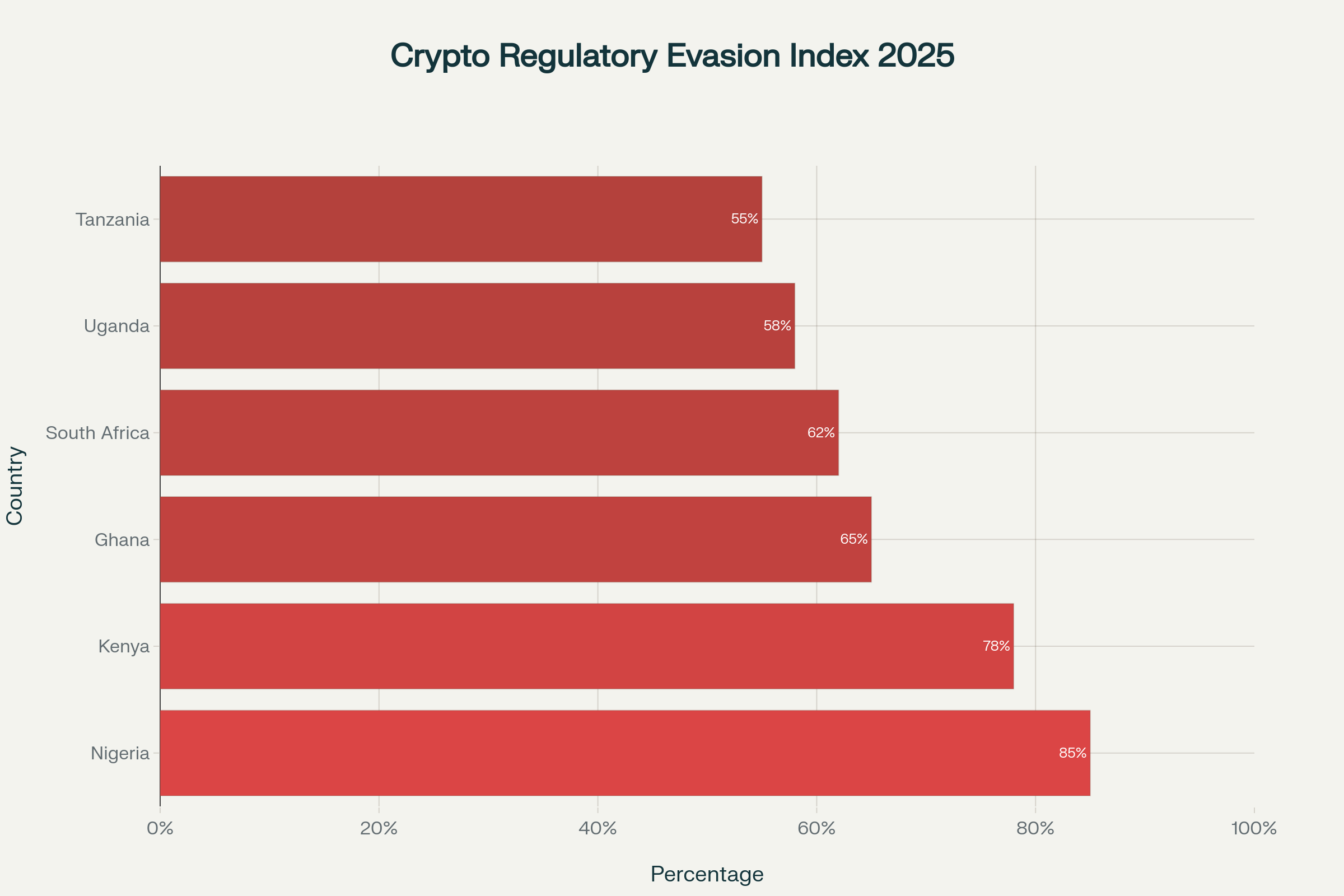

The numbers are staggering. Conservative estimates suggest that 85 percent of cryptocurrency transactions in Nigeria occur outside regulatory oversight, while Kenya follows closely at 78 percent. This unregulated activity spans multiple sectors, from remittances and trade finance to tax evasion and money laundering.

African countries ranked by exposure to unregulated cryptocurrency activities

“What we’re witnessing is the emergence of a parallel financial system that operates beyond traditional regulatory frameworks,” explains Dr. Akinwunmi Ambode, a financial crime specialist at the University of Lagos who has studied cryptocurrency flows across West Africa. “The sophistication of these bypass mechanisms suggests organized networks rather than individual actors.”

Nigeria: The Epicenter of Financial Innovation and Evasion

Nigeria’s experience with cryptocurrency regulation illustrates both the promise and perils of digital currency adoption in Africa. Following Central Bank of Nigeria (CBN) restrictions on bank transactions involving cryptocurrency in 2021, trading volume shifted to peer-to-peer platforms that operate outside traditional banking systems.

Physical representation of bitcoin alongside US dollars and cryptocurrency QR codes, illustrating currency exchange and financial transactions

Internal CBN documents obtained during this investigation reveal growing concern about the scale of regulatory bypass. “Cryptocurrency has no place in our monetary system at this time and cryptocurrency transactions should not be carried out through the Nigerian banking system,” stated CBN Governor Godwin Emefiele in February 2021.

Yet the restrictions appear to have driven activity underground rather than eliminating it. Abraham Udu, Director of Programs at the Association of Certified Financial Crime Specialists West Africa Chapter, describes the current situation: “Nigeria seems to lead the pack and has acknowledged the need through updated investment laws, but there’s a glaring gap between policy intention and operational enforcement”.

The consequences extend beyond financial oversight. A 2025 International Monetary Fund report on Nigeria’s crypto market notes that “the use of crypto assets to transfer money across borders while bypassing existing capital control measures poses a significant risk”. The report details schemes where investors use cryptocurrency to move money overseas without detection, effectively circumventing capital flow regulations.

The P2P Revolution: Technology Enabling Regulatory Bypass

Peer-to-peer trading platforms have emerged as the primary vehicle for regulatory evasion across Africa. These platforms allow direct transactions between individuals without intermediary oversight, making them attractive to users seeking to avoid traditional banking restrictions.

Illustration of peer-to-peer cryptocurrency trading via mobile in Nigeria, showing buying and selling between individuals using Naira and Ethereum coins

The mechanics are sophisticated yet accessible. Users can convert local currencies to cryptocurrency through P2P platforms, transfer the digital assets across borders instantaneously, then convert back to foreign currencies – all while avoiding detection by financial authorities. The entire process can be completed within minutes using nothing more than a smartphone and internet connection.

Dr. Kemi Adeosun, a blockchain researcher at the Lagos Business School who has tracked P2P trading patterns, explains the appeal: “These platforms offer speed, convenience, and anonymity that traditional banking cannot match. For many users, regulatory bypass is not the primary motivation, but it becomes an attractive secondary benefit”.

However, the same characteristics that make P2P platforms attractive to legitimate users also facilitate criminal activity. Financial intelligence units across Africa report increasing use of these platforms for money laundering, terrorism financing, and tax evasion.

Kenya: Mobile Money Meets Digital Currency

Kenya’s sophisticated mobile money infrastructure has created unique opportunities for cryptocurrency regulatory bypass. The country’s widespread adoption of M-Pesa and similar platforms provides seamless integration with cryptocurrency trading, allowing users to convert mobile money directly to digital assets.

The Financial Reporting Centre of Kenya’s 2024 Virtual Assets Risk Assessment identified concerning patterns among cryptocurrency users. The report documented cases of 12 Kenyan nationals aged 20 to 23 who opened cryptocurrency wallets in Malta and conducted identical transaction patterns totaling 55.7 million Kenyan shillings before disappearing when asked to provide supporting documentation.

“These guys were money mules and the fact that these are young people aged 20 to 23 says a lot,” noted a financial intelligence analyst familiar with the investigation. The case illustrates how cryptocurrency networks recruit young Africans to facilitate regulatory bypass schemes that often have international dimensions.

Kenya’s regulatory response has been reactive rather than proactive. In February 2024, the Directorate of Criminal Investigations issued alerts about cryptocurrency platforms being used for fraud schemes, but comprehensive regulation remains pending. The National Treasury has directed the Financial Reporting Centre to develop a regulatory framework, but implementation timelines remain unclear.

South Africa: Advanced Markets, Sophisticated Evasion

South Africa represents the most sophisticated cryptocurrency market on the continent, with advanced trading platforms and relatively developed regulatory frameworks. However, this sophistication has also enabled more complex forms of regulatory bypass.

Close-up of South African banknotes featuring the South African Reserve Bank text and currency details

A landmark 2025 court ruling in Standard Bank of South Africa v South African Reserve Bank established that cryptocurrencies fall outside existing exchange control regulations, creating a legal vacuum that facilitates unregulated cross-border transactions. The judgment stated unequivocally: “Given the punitive nature of the Exchange Control Regulations, there is no room for an unnatural and fictitious reading into the Regulations to cover cryptocurrency”.

The ruling has profound implications for financial oversight. Finance Minister Enoch Godongwana acknowledged that South Africa would introduce a targeted framework for cross-border crypto asset transfers, but the regulatory gap persists. Financial intelligence reports indicate that South Africa experiences 62 percent of cryptocurrency transactions outside regulatory oversight, with sophisticated networks exploiting legal ambiguities.

The Financial Intelligence Centre of South Africa’s 2025 sector risk assessment identified multiple concerning trends, including the operation of unregistered cryptocurrency service providers and transaction patterns indicating money laundering risks. The report noted that nine crypto asset service providers were associated with transactions in the “severe risks” group, involving crimes such as terrorism financing and sanctions violations.

Ghana: Tax Evasion Through Digital Anonymity

Ghana’s cryptocurrency market has experienced rapid growth, but regulatory frameworks lag behind adoption rates. The Bank of Ghana’s 2024 Money Laundering and Terrorism Financing Risk Assessment on Virtual Assets revealed systematic tax evasion through cryptocurrency transactions.

A smartphone app displaying Bitcoin price and trading options alongside physical Bitcoin coins

The assessment documented multiple cases of high-net-worth individuals using cryptocurrencies to conceal wealth and evade taxes. In one case, Ghana Revenue Authority investigators discovered individuals converting significant income into digital wallets, avoiding tax declarations while moving funds across borders. The anonymity provided by cryptocurrencies allowed them to transfer funds without detection, complicating efforts to trace and recover evaded taxes.

“Crypto could become a backdoor for illicit financing, money laundering, tax evasion, and speculative bubbles,” warns a senior analyst at Stanbic Bank Ghana. The concern reflects broader challenges facing African tax authorities as cryptocurrency adoption outpaces regulatory development.

Ghana’s response has been cautious but increasingly engaged. Bank of Ghana Governor Dr. Ernest Addison recently announced that the central bank is developing a regulatory framework for cryptocurrency, signaling a shift from resistance to engagement.

Uganda: Regulatory Vacuum Fuels Illicit Flows

Uganda represents one of Africa’s most concerning cases of cryptocurrency regulatory bypass. The Uganda Revenue Authority has issued urgent warnings about rising illicit financial flows facilitated by unregulated digital currencies.

A senior URA official describes the situation: “Cryptocurrencies are not the enemy, but like any financial instrument, they must be regulated. In their current state, they offer a perfect conduit for tax evasion, money laundering, and cross-border smuggling—especially in high-value sectors like gold”.

The country’s informal economy, representing more than half of Uganda’s economic activity, provides fertile ground for cryptocurrency-based regulatory bypass. Traders, freelancers, and exporters increasingly use digital currencies to avoid the formal banking system, rendering transactions invisible to regulators.

Particularly concerning is the use of cryptocurrency in gold smuggling operations. URA investigators have documented cases where proceeds from illicit gold exports are converted into cryptocurrency and transferred abroad, avoiding banking oversight and taxation entirely. Platforms such as Binance P2P and Paxful facilitate these transactions without mandatory know-your-customer checks, leaving major regulatory gaps.

Mozambique: Terrorism Financing and Digital Currency

Mozambique faces unique challenges as cryptocurrency networks intersect with terrorism financing in the northern Cabo Delgado province. The Reserve Bank of Mozambique has imposed strict limits on mobile money accounts to curb terrorist financing, but cryptocurrency transactions remain largely unregulated.

The UN Office on Drugs and Crime has provided specialized training to Mozambican authorities on cryptocurrency-facilitated drug trafficking, recognizing the growing sophistication of digital currency networks. The training focused on blockchain analysis and open-source intelligence techniques needed to trace cryptocurrency transactions used by criminal networks.

“The rise of cryptocurrencies has provided drug traffickers with sophisticated ways to conceal their activities, posing a major challenge for law enforcement,” explains the UNODC Regional Coordinator. The challenge is particularly acute in Mozambique, where weak regulatory frameworks combine with active terrorist and criminal networks.

Comparative Perspectives: Lessons from Global Experience

Africa’s experience with cryptocurrency regulatory bypass mirrors patterns observed globally but with distinct characteristics shaped by the continent’s financial infrastructure and regulatory capacity.

The European Union Model

The European Union’s Markets in Crypto-Assets (MiCA) regulation provides comprehensive oversight of cryptocurrency activities, including mandatory licensing for service providers and strict anti-money laundering requirements. MiCA’s implementation has significantly reduced regulatory bypass opportunities, offering lessons for African regulators.

“The European approach demonstrates that comprehensive regulation is both feasible and necessary,” argues Professor Erik Vermeulen of Tilburg University, who has studied cryptocurrency regulation across multiple jurisdictions. “However, successful implementation requires significant regulatory capacity and enforcement mechanisms that many African countries currently lack.”

Singapore’s Balanced Framework

Singapore’s approach balances innovation with oversight through a regulatory sandbox that allows controlled experimentation with cryptocurrency services. The Monetary Authority of Singapore requires licensing for cryptocurrency businesses while providing clear guidelines for compliance.

The Singapore model has achieved regulatory clarity without stifling innovation, resulting in a thriving cryptocurrency sector with minimal regulatory bypass. However, implementing similar frameworks in Africa would require substantial capacity building and institutional development.

The Technology of Evasion

Understanding cryptocurrency regulatory bypass requires examining the technological mechanisms that enable it. Blockchain technology, while providing transaction transparency, also enables pseudonymous transactions that can obscure beneficial ownership and true transaction purposes.

Privacy Coins and Mixing Services

Advanced cryptocurrency users employ privacy-focused digital currencies such as Monero and Zcash that offer enhanced anonymity features. These “privacy coins” make transaction tracing extremely difficult, even for sophisticated blockchain analysis tools.

Mixing services, also known as cryptocurrency tumblers, further obscure transaction trails by pooling funds from multiple users and redistributing them in ways that break the connection between senders and recipients. Several Africa-focused mixing services have emerged to serve users seeking enhanced privacy.

Decentralized Exchanges

Decentralized exchanges (DEXs) allow cryptocurrency trading without centralized oversight or know-your-customer requirements. Users can trade directly with each other using smart contracts, bypassing traditional exchange controls and reporting requirements.

The growth of DEX trading in Africa has been particularly pronounced in countries with restrictive cryptocurrency regulations. Data from DeFiLlama shows significant adoption of decentralized trading protocols across major African markets.

The Professional Services Network

Cryptocurrency regulatory bypass in Africa operates within an ecosystem of enabling services that facilitate sophisticated evasion schemes. This network includes both legitimate service providers whose services are misused and explicitly criminal organizations.

Legal and Accounting Services

International law firms and accounting companies inadvertently enable regulatory bypass by establishing corporate structures that obscure cryptocurrency ownership and control. These structures often span multiple jurisdictions, making regulatory oversight extremely difficult.

A former compliance officer at a major international accounting firm, speaking on condition of anonymity, describes the challenge: “Clients demand cryptocurrency-related services that push the boundaries of existing regulations. The commercial pressure to accommodate these requests is enormous, especially when competitors are willing to provide such services.”

Technical Infrastructure Providers

Cryptocurrency infrastructure providers, including wallet services, mining operations, and blockchain analytics companies, play crucial roles in enabling or preventing regulatory bypass. Some providers actively market privacy features that facilitate evasion, while others cooperate with law enforcement investigations.

The concentration of cryptocurrency infrastructure in jurisdictions with weak oversight creates systematic vulnerabilities that criminal networks exploit. Several major cryptocurrency service providers serving African markets operate from jurisdictions with limited regulatory oversight or international cooperation.

Law Enforcement Challenges

African law enforcement agencies face significant challenges in addressing cryptocurrency regulatory bypass, including technical complexity, jurisdictional issues, and resource constraints.

Technical Expertise Gaps

Most African law enforcement agencies lack the technical expertise needed to investigate cryptocurrency-related crimes. Blockchain analysis requires specialized knowledge and expensive software tools that are beyond the reach of many agencies.

Inspector James Kariuki of the Kenya Police Cyber Crime Unit describes the challenge: “We receive reports of cryptocurrency fraud and money laundering, but investigating these cases requires technical skills and tools we don’t have. By the time we can engage external expertise, the digital trails have often gone cold.”

Jurisdictional Complications

Cryptocurrency transactions typically span multiple jurisdictions, requiring international cooperation that can be slow and complex. Criminal networks exploit these jurisdictional gaps to structure transactions across multiple countries, making prosecution extremely difficult.

Resource Constraints

Financial crime investigation requires significant resources, including specialized personnel, technology, and international cooperation mechanisms. Most African countries struggle to allocate sufficient resources to cryptocurrency enforcement, creating systematic vulnerabilities that criminal networks exploit.

The Human Cost

Behind the technical complexity of cryptocurrency regulatory bypass lie real human consequences that affect millions of Africans. These range from individual fraud victims to broader economic impacts on national development.

Fraud Victims

Cryptocurrency fraud has become endemic across Africa, with victims losing billions of dollars to Ponzi schemes, fake exchanges, and investment scams. The lack of regulatory oversight makes recovery extremely difficult, while the sophistication of fraud schemes continues to increase.

Mary Okafor, a teacher from Abuja who lost her life savings to a cryptocurrency investment scheme, describes her experience: “They promised 50 percent returns every month and showed me documentation that looked official. When I tried to withdraw my money, they said there were ‘network issues’ and I needed to pay additional fees. I never saw my money again.”

Economic Development Impact

Cryptocurrency regulatory bypass undermines African economic development by facilitating tax evasion, capital flight, and corruption. Resources that should fund public services and infrastructure instead flow to offshore accounts and cryptocurrency wallets beyond regulatory reach.

Dr. Hippolyte Fofack, Chief Economist at the African Export-Import Bank, explains the broader impact: “When domestic resources are diverted through unregulated cryptocurrency networks, it reduces the fiscal space available for development spending. This perpetuates cycles of underdevelopment and dependence on external financing.”

Regulatory Responses and Their Limitations

African governments have responded to cryptocurrency regulatory bypass with varying approaches, from outright bans to attempts at comprehensive regulation. However, most responses have proven inadequate to address the scale and sophistication of bypass mechanisms.

The Ban Approach

Countries including Algeria, Morocco, and Egypt have implemented comprehensive bans on cryptocurrency transactions. However, these bans often prove ineffective, driving activity underground without eliminating it.

The Algerian experience illustrates the limitations of prohibition. Despite criminal penalties for cryptocurrency transactions, underground markets continue to operate using peer-to-peer platforms and foreign exchanges. Enforcement is sporadic and largely ineffective.

Selective Regulation

Countries like Nigeria and South Africa have attempted selective regulation, allowing certain cryptocurrency activities while restricting others. This approach creates regulatory arbitrage opportunities that sophisticated users exploit to engage in bypass activities.

Comprehensive Frameworks

Few African countries have developed comprehensive cryptocurrency regulatory frameworks that address bypass concerns while allowing legitimate innovation. Ghana’s emerging approach, which balances oversight with market development, may provide a model for other countries.

The Role of International Cooperation

Addressing cryptocurrency regulatory bypass requires international cooperation, as digital currency networks typically span multiple jurisdictions. However, cooperation mechanisms remain underdeveloped, creating systematic vulnerabilities.

The FATF Travel Rule

The Financial Action Task Force’s Travel Rule requires cryptocurrency service providers to collect and transmit customer information for transactions above specified thresholds. However, implementation across Africa remains limited, with most countries lacking the technical and regulatory infrastructure needed for compliance.

Abraham Udu of the Association of Certified Financial Crime Specialists explains the challenge: “West Africa has no regional directives yet, and national crypto/VASP laws are largely pending or non-existent. The region remains in the ‘sunrise phase’ of implementation, struggling with resource constraints, fragmented crypto policy frameworks, and capacity issues”.

Information Sharing Mechanisms

Effective cryptocurrency oversight requires real-time information sharing between financial intelligence units, law enforcement agencies, and regulatory authorities. However, most African countries lack the technical infrastructure and legal frameworks needed for effective information sharing.

Capacity Building Initiatives

International organizations including the UN Office on Drugs and Crime, the World Bank, and regional development banks have launched capacity building programs to help African countries address cryptocurrency regulatory bypass. However, these programs remain limited in scope and impact.

Emerging Technologies and Future Challenges

The cryptocurrency regulatory bypass challenge continues to evolve as new technologies emerge. African regulators must anticipate future developments while addressing current gaps.

Central Bank Digital Currencies

Several African central banks are exploring central bank digital currencies (CBDCs) as potential responses to cryptocurrency adoption. The Central Bank of Nigeria’s eNaira and other CBDC initiatives aim to provide government-backed digital currency alternatives.

However, CBDCs face significant adoption challenges and may not address the fundamental appeal of decentralized cryptocurrencies. Early experience with the eNaira suggests limited uptake compared to private cryptocurrency alternatives.

Decentralized Finance (DeFi)

Decentralized finance protocols enable complex financial services without traditional intermediaries, creating new opportunities for regulatory bypass. DeFi adoption in Africa remains limited but is growing rapidly, particularly among technically sophisticated users.

Non-Fungible Tokens (NFTs)

Non-fungible tokens have emerged as a new vector for value transfer and potential regulatory bypass. While NFT markets in Africa remain nascent, they represent a growing concern for financial oversight authorities.

The Path Forward: Recommendations for Reform

Addressing cryptocurrency regulatory bypass in Africa requires comprehensive reform across multiple dimensions, from legal frameworks to technical capacity and international cooperation.

Regulatory Framework Development

African countries need comprehensive cryptocurrency regulatory frameworks that balance innovation with oversight. These frameworks should address licensing requirements for service providers, anti-money laundering obligations, consumer protection measures, and cross-border transaction monitoring.

Key elements should include:

- Clear legal definitions of cryptocurrency and related services

- Mandatory licensing for cryptocurrency service providers

- Anti-money laundering and counter-terrorism financing requirements

- Consumer protection measures and fraud prevention

- Cross-border transaction reporting and monitoring

- Enforcement mechanisms and penalties for violations

Capacity Building

Effective cryptocurrency regulation requires significant capacity building across government institutions. This includes technical training for law enforcement, regulatory staff development, and institutional infrastructure development.

Priority areas include:

- Blockchain analysis and digital forensics training

- Regulatory technology implementation

- Legal framework development

- International cooperation mechanisms

- Public education and awareness campaigns

Regional Cooperation

Cryptocurrency regulatory bypass cannot be addressed by individual countries alone. Regional cooperation through organizations like the Economic Community of West African States (ECOWAS) and the African Union is essential for effective oversight.

Regional initiatives should include:

- Harmonized regulatory frameworks

- Information sharing mechanisms

- Joint enforcement operations

- Technical assistance programs

- Capacity building coordination

Technology Solutions

Regulatory technology solutions can help African countries monitor cryptocurrency transactions and detect bypass activities. However, implementing these solutions requires significant investment and technical expertise.

Key technologies include:

- Blockchain analysis platforms

- Transaction monitoring systems

- Risk assessment tools

- Reporting and compliance platforms

- International data sharing systems

Industry Perspectives and Stakeholder Views

The cryptocurrency industry in Africa has diverse perspectives on regulatory bypass, ranging from legitimate businesses seeking clarity to criminal networks exploiting regulatory gaps.

Legitimate Industry Concerns

Established cryptocurrency businesses in Africa generally support reasonable regulation that provides clarity and protects consumers while enabling innovation. These businesses argue that regulatory uncertainty forces them to compete with unregulated operators who can offer riskier services.

Chris Maurice, CEO of Yellow Card, Africa’s largest cryptocurrency exchange, explains the industry perspective: “Clear regulations benefit everyone – users get protection, governments get oversight, and legitimate businesses can compete fairly. The current regulatory uncertainty hurts everyone except bad actors”.

Civil Society Perspectives

African civil society organizations have raised concerns about both cryptocurrency risks and heavy-handed regulatory responses that could limit financial inclusion benefits.

Mercy Kamau, Communications Officer at Tax Justice Network Africa, emphasizes the need for balanced approaches: “We need regulatory bodies across the continent to strengthen financial policies governing the use of cryptocurrencies while ensuring that those who misuse these technologies to finance crime are held accountable”.

Academic Analysis

African academic institutions have begun researching cryptocurrency regulatory bypass, providing evidence-based analysis of the phenomenon and potential solutions.

Dr. Godwin Ojo of Environmental Rights Action notes: “When ownership is opaque and accountability is diffused through complex technological structures, financial crimes become someone else’s problem. Communities suffer while profits are extracted through systems designed to avoid responsibility.”

Economic Impact Assessment

The economic impact of cryptocurrency regulatory bypass extends beyond immediate financial losses to broader effects on African development and financial stability.

Revenue Losses

Tax authorities across Africa report significant revenue losses due to cryptocurrency-facilitated tax evasion. The Ghana Revenue Authority estimates that high-net-worth individuals have used cryptocurrencies to avoid declaring millions of cedis in taxable income.

Similar patterns exist across the continent. Uganda Revenue Authority officials warn that unregulated cryptocurrency adoption undermines tax collection, while South African authorities express concern about exchange control evasion through digital currencies.

Financial Stability Risks

Widespread cryptocurrency regulatory bypass poses systemic risks to African financial stability. These risks include:

- Reduced effectiveness of monetary policy

- Increased vulnerability to financial crimes

- Systemic risks from unregulated financial activities

- Reduced government revenue for public services

- Increased exposure to international financial volatility

Development Consequences

The diversion of resources through cryptocurrency bypass mechanisms reduces funding available for African development priorities. This creates a vicious cycle where weak governance enables regulatory bypass, which in turn undermines the resources needed to strengthen governance.

The International Dimension

Cryptocurrency regulatory bypass in Africa cannot be understood without examining its international dimensions. Digital currency networks typically involve multiple jurisdictions, creating complex regulatory and enforcement challenges.

Offshore Financial Centers

Many cryptocurrency bypass schemes involve offshore financial centers that provide secrecy and limited cooperation with African authorities. These jurisdictions often host cryptocurrency exchanges, wallet services, and other infrastructure used to facilitate bypass activities.

Correspondent Banking Relationships

Traditional banking relationships continue to play important roles in cryptocurrency bypass schemes, particularly at the entry and exit points where digital currencies are converted to traditional currencies. International banks with African operations face increasing scrutiny for their role in facilitating these activities.

International Standards and Cooperation

International standards-setting bodies, particularly the Financial Action Task Force, have developed guidelines for cryptocurrency oversight. However, implementation across Africa remains limited, creating systematic vulnerabilities that international networks exploit.

Future Scenarios and Projections

The trajectory of cryptocurrency regulatory bypass in Africa will depend on multiple factors, including technological developments, regulatory responses, and broader economic conditions.

Scenario 1: Regulatory Convergence

In this scenario, African countries successfully develop comprehensive cryptocurrency regulatory frameworks that reduce bypass opportunities while enabling legitimate innovation. Regional cooperation mechanisms facilitate information sharing and joint enforcement, while capacity building programs strengthen regulatory capabilities.

This scenario would likely result in reduced regulatory bypass, increased tax compliance, and better consumer protection. However, it requires significant political will, international cooperation, and resource allocation.

Scenario 2: Regulatory Fragmentation

This scenario sees continued divergence in regulatory approaches across Africa, with some countries implementing comprehensive frameworks while others maintain restrictive or unclear policies. Regulatory arbitrage increases as sophisticated users exploit differences between jurisdictions.

In this scenario, regulatory bypass would likely continue to grow, concentrating activity in countries with the weakest oversight. Cross-border coordination would remain limited, while criminal networks would become more sophisticated.

Scenario 3: Technology-Driven Disruption

New technological developments could fundamentally alter the cryptocurrency regulatory bypass challenge. Central bank digital currencies might provide viable alternatives to private cryptocurrencies, while advances in blockchain analysis could make transaction tracing more effective.

Alternatively, new privacy technologies could make regulatory bypass easier and more widespread, overwhelming existing oversight capabilities.

Conclusion: The Imperative for Action

The evidence presented in this investigation demonstrates that cryptocurrency regulatory bypass has become a systematic challenge across Africa, undermining financial oversight, facilitating criminal activity, and diverting resources needed for development. The scale of unregulated cryptocurrency activity – estimated at $42.6 billion annually – represents a significant threat to African financial stability and governance.

The sophisticated networks facilitating regulatory bypass operate across multiple jurisdictions, exploit technological complexity, and adapt rapidly to enforcement efforts. Individual country responses have proven inadequate, while regional cooperation remains limited. The human cost includes fraud victims, reduced public revenues, and broader development impacts.

However, the challenge is not insurmountable. Countries like South Africa and Ghana are developing comprehensive regulatory approaches that balance innovation with oversight. International cooperation mechanisms are evolving, while technological solutions offer new possibilities for transaction monitoring and analysis.

The time for half-measures has passed. African governments, international partners, and the global community must recognize cryptocurrency regulatory bypass as the systematic threat it has become and respond with the urgency and resources the challenge demands.

This requires comprehensive regulatory frameworks that address current gaps while anticipating future developments. It demands significant investment in capacity building, technology, and international cooperation. Most importantly, it requires recognition that cryptocurrency regulation is not a technical issue but a fundamental question of financial sovereignty and development.

The choice facing African policymakers is clear: develop effective responses to cryptocurrency regulatory bypass now, or watch as parallel financial systems continue to grow beyond the reach of democratic oversight and accountability. The cost of inaction will be measured not only in billions of dollars in lost revenue but in the perpetuation of systems that enable corruption, crime, and the systematic extraction of African wealth.

The technology exists, the knowledge is available, and the stakes could not be higher. What remains is the political will to act before the window of opportunity closes and cryptocurrency regulatory bypass becomes too entrenched to address effectively.

The future of African financial sovereignty may well depend on the choices made in the next critical years. The evidence is clear, the challenge is defined, and the time for action is now.

Citations and Sources

Tax Justice Network Africa. (2025). “Experts Call for Strengthened Regulations to Combat Crypto-Fueled Crime in Africa.” ADDO Symposium report.

IYE Global. (2024). “Money Laundering in Africa Through Cryptocurrency.” Financial crime analysis.

Baker McKenzie. (2019). “Blockchain and Cryptocurrency in Africa.” Regional regulatory survey.

Digital Watch Observatory. (2025). “New Framework Planned for Crypto Asset Flows in South Africa.” Regulatory update.

Wikipedia. “Legality of Cryptocurrency by Country or Territory.” Regulatory status compilation.

International Monetary Fund. (2022). “Africa’s Growing Crypto Market Needs Better Regulations.” Policy analysis.

Michalsons. (2025). “Cryptocurrency Regulation in South Africa.” Legal compliance guide.

Science Direct. (2025). “The Dark Arts of Crypto Laundering and the Nigerian Context.” Academic research.

Financial Crime Academy. “Cryptocurrency in Africa: Adequate Laws and Regulations.” Educational analysis.

Partner With Us for Impactful Change

Ready to drive transparency and accountability in your sector?

Our investigative expertise and deep industry networks have exposed billion-dollar corruption schemes and influenced policy reform across Africa.

Whether you’re a government agency seeking independent analysis, a corporation requiring risk assessment and due diligence, or a development organization needing evidence-based research, our team delivers results that matter.

Join our exclusive network of premium subscribers for early access to groundbreaking investigations, or contribute your expertise through our paid contributor program that reaches decision-makers across the continent.

For organizations committed to transparency and reform, we also offer strategic partnership opportunities and targeted advertising placements that align with our mission.

Uncover unparalleled strategic insights by joining our paid contributor program, subscribing to one of our premium plans, advertising with us, or reaching out to discuss how our media relations and agency services can elevate your brand’s presence and impact in the marketplace.

Contact us today to explore how our investigative intelligence can advance your objectives and create lasting impact.