YouTube’s Creator Partnership Program (YPP) ostensibly shares advertising income fairly with eligible creators – roughly 55% of ad revenue goes to the creator, 45% to YouTube. Under this system, creators who reach the YPP eligibility thresholds (typically 1,000 subscribers and 4,000 watch hours per year, or 10 million Shorts views) can monetize their channels.

In addition to video ad revenue, creators may earn from channel memberships, Super Chat and sticker sales, merchandise shelf integrations, and YouTube Premium revenues. According to YouTube documentation, creators must also connect a Google AdSense account and meet a $100 payment threshold before funds are disbursed. In theory, the model is straightforward: as one industry guide explains, “YouTube splits ad revenue 55/45 with creators” and rewards popular content with proportional earnings.

Revenue sharing: By policy, creators receive 55% of ad revenue (after ads run on their videos).

Earning methods: Income comes from video ads, channel memberships, live-stream donations (Super Chats), merchandise sales, and Premium subscription streams.

Eligibility: To join YPP, a channel typically needs ≥1,000 subscribers and ≥4,000 valid public watch hours in the past 12 months (or an alternate Short-views threshold).

Payments: Ad earnings accumulate in AdSense; a minimum balance (usually ~$100) is required before YouTube issues a payment.

This setup underlies billions in annual payouts: for example, YouTube announced in 2024 that it had paid out over $60 billion to creators (past promises had cited $100B+ over time).

However, multiple creators and analysts have begun flagging anomalies and “shortfalls” that suggest not all promised revenue is reaching creators.

The investigation about YouTube Revenue Manipulation below examines claims of “revenue manipulation” – systematic underreporting or diversion of creator earnings – within the official YouTube Partner Program and via third-party networks. Real examples, statements and documents are analyzed to determine whether the public YPP framework is being adhered to.

Unexplained Drops in AdSense Earnings

Despite the clean arithmetic of 55/45 revenue split, many YPP creators have reported puzzling discrepancies between expected and actual earnings. In late 2022 and early 2023, dozens of prominent YouTubers noticed their AdSense revenues were crashing for no apparent reason. The drop affected creators in diverse niches – from tech vloggers to animators – and sometimes appeared as a sudden 50–90% decline in estimated income.

Tech journalist John Koetsier collected multiple such accounts and reported that “multiple YouTube creators are claiming that a YouTube bug is costing them between 50% to 90% of their income”. One Dutch creator, Hessel Broekstra, illustrated the impact: his RPM (revenue per thousand views) plummeted from roughly $2.00 to just $0.12–$0.22 on many recent videos. In real terms, creators like Broekstra said they saw months of earnings vanish from their AdSense statements.

YouTube’s own analytics often showed an unexplained “holdback” or delay in revenue. Creators noted that YouTube Studio sometimes reported far lower daily projected earnings than the same content was actually achieving in views. A large community of affected creators exchanged stories in forums and comment sections: one noted their income had “dropped month after month… about 75% since January” of 2025, while views held steady.

Another thread captured a plea, saying “this [bug] is eating creators alive…something strange has happened” (Reddit, Jan 2025). Creators emphasized that the shortfall was not due to demonetization or strikes on their channels, but a backend reporting issue – an “invalid traffic” bug or similar glitch – that undercounted legit ad-views and withheld payouts.

By early 2023, affected creators pushed for answers. In February 2023, the YouTube partner support forum quietly acknowledged a problem: a known-issues post admitted “some creators are seeing incorrect ad revenue numbers on their newly uploaded videos” and stated “the YT monetization team is aware of the issue and is actively investigating it”. (This notice was later removed from public view but was documented by creator communities.) In other words, YouTube recognized a glitch in revenue reporting.

Following the admission, some creators reported partial fixes: views that were previously showing no ads “retroactively” earned small amounts, suggesting YouTube restored some funds. Nonetheless, the episode left many questioning whether all owed ad revenue was fully recovered, and why such a serious bug went unmentioned by YouTube until creators uncovered it.

Further complicating matters, creators have identified other factors that can reduce reported earnings without clear explanation. YouTube’s own public help pages hint at some issues: for example, if certain views are deemed “invalid” (from bots or click farms), the corresponding ad money is withheld or returned to advertisers.

Technical problems like ad delivery failures can also silently depress RPM. Still, the scale of recent complaints – some creators losing up to 90% of expected revenue – far exceeds normal adjustments. Many suspect these cases go beyond mere algorithmic filtering of invalid traffic and point to deeper reporting or payment problems in the YPP system.

Bugged Analytics: Since late 2022, creators reported sudden, unexplained drops in YouTube Analytics and AdSense earnings (often 50–90% lower than expected).

Invalid Traffic Filtering: YouTube may remove revenue from suspected bot clicks, but creators say the magnitude of recent losses suggests more than routine filtering.

Revenue Reporting Glitch: By Feb 2023, YouTube publicly acknowledged an “issue with ad revenue metrics” affecting new videos, indicating that some ad-view data was missing or miscounted.

Cashflow Impact: Creators say the hole in income forced them to dip into savings or pause growth. One tech YouTuber noted month-after-month declines, with “views and revenues way down” despite no change in content.

These anomalies have eroded trust. Veteran creator Chris Stuckmann, who films movie reviews, remarked in late 2018 that he “still hasn’t gotten [his] AdSense money for September” after a network collapse (see below), and needed to tap savings. Such anecdotes suggest that any under-reported revenue can leave creators financially strapped. In essence, the official YPP math no longer matches reality for many content producers, sparking suspicions of systematic issues in YouTube’s earnings accounting.

YouTube’s Official Responses and Policy Issues

When concerns about missing revenue surfaced, YouTube’s corporate communications have remained sparse. Apart from the known-issues forum post admitting a “revenue metrics” bug, the company has offered few public explanations. In fact, some YouTube support documentation reinforces why creators see discrepancies: one Google help article notes that estimated earnings in Analytics can be higher than the final AdSense payout because YouTube continues to review traffic quality.

The platform also warns that only ad views that meet advertiser criteria (e.g. full ad watches or valid impressions) count toward revenue. This means final payouts often trail initial estimates. However, creators feel that these standard disclaimers do not justify the wild fluctuations experienced in late 2022–2023.

Notably, YouTube’s own monetization rules give it broad discretion. The YPP terms of service reserve the right to audit earnings and to hold or adjust payments for any “invalid traffic” or policy violations. In practice, when creators see an “Estimated Ad Revenue” in Studio, YouTube may later revise it downward in AdSense.

The Help Center explains that AdSense totals may differ from Studio’s chart because of timing (some payments are delayed one month) or adjustments. YouTube also points out that revenue from YouTube Premium subscribers is shared differently (creators get a larger share of Premium fees), which can complicate comparisons.

In response to repeated creator outcries, Google has convened internal investigations. Insiders report that YouTube engineers updated their ad-processing pipeline in late 2022, which accidentally introduced a reporting bug. By mid-2023, YouTube claimed the issue was fixed. Yet many creators maintain not all lost money was fully credited back.

Some region-specific regulators have taken notice: for instance, India’s IT minister asked YouTube to explain mysterious channel bans and ad cuts (though this was largely about compliance, not revenue). To date, no formal explanation or compensation framework has been provided to affected creators. The lack of transparent accounting standards continues to fuel allegations that YouTube’s official figures do not capture what creators truly earned or were owed.

Analytics vs. AdSense: YouTube admits that Analytics’ “Estimated Revenue” can differ from final payouts, due to review processes and timing. This standard caveat doesn’t fully explain the magnitude of recent revenue drops.

Policy Discretion: YPP terms allow YouTube to withhold funds for “invalid traffic” or policy issues. Creators say these clauses are applied opaquely.

Limited Transparency: Apart from a brief known-issues notice, YouTube has not publicly detailed any fixes or audits, leading creators to demand clarity on how their money is counted and paid.

In summary, while YouTube’s help documentation outlines normal reasons for earnings variance, the scale of complaints suggests systemic flaws. Many creators now question whether the platform’s official figures – promoted as reliable metrics – are being intentionally skewed or mishandled. The combination of opaque algorithms, occasional bugs, and policy flexibility sets the stage for deep distrust, which investigative scrutiny aims to address.

Multi-Channel Networks: Promises and Pitfalls

Beyond YouTube’s own systems, third-party Multi-Channel Networks (MCNs) have long played a role in creator monetization. MCNs are companies that sign up YouTube channels and promise to handle business affairs (like ad sales and brand deals) in exchange for a share of revenue. A channel’s contract with an MCN might stipulate split percentages, special services, or priority ad placements.

Historically, MCNs offered smaller creators a pathway to sponsorships and support that a solo channel might struggle to secure. However, recent cases reveal that MCNs themselves have become flashpoints of contention: creators allege that some networks have withheld earnings, misled partners, or disappeared with funds.

The Defy Media collapse of late 2018 is a dramatic example. Defy Media was a large MCN (owner of Smosh, Clevver, etc.) that abruptly folded, leaving dozens of creators unpaid. In The Verge, Smosh co-founder Anthony Padilla and other creators described the fallout. Padilla lamented, “I sold Smosh for zero dollars… we were taken advantage of”, referring to how Defy had promised stock value that never materialized. More pointedly, creator Ryland Adams stated: “[Defy] held our checks. They literally stole my money.

I should have gotten my check three days before [they folded], but instead they chose to not pay us out”. These first-person testimonies indicate that Defy not only failed to distribute ad revenues and sponsorship fees, but also shut off communication. Lawsuits soon followed: production group Shandy Media sued Defy for an unpaid $100,000 in ad revenue, and other partners filed class actions. In effect, Defy’s case exposed how an MCN’s collapse can instantly block creator payments – a risk not visible when creators sign on for support.

Defy’s demise highlights a broader shift away from MCNs. Originally, networks promised protection against YouTube’s flaws. As The Verge notes, MCNs once acted as “safe harbors”: they guaranteed advertisers would fill creator videos with ads, shielding channels from ad shortages or demonetization. But policy changes erased that advantage. In 2017 YouTube ended the “managed partner” tier, forcing all creators back into the standard 55/45 YPP regardless of network membership.

After this change, creators realized MCNs no longer delivered extra ad placements or check-payment advantages. One frustrated partner said the outcome was that “creators would be giving away a percentage of their profits without any promised revenue in return”. In short, MCNs lost their main leverage, but still often kept contractual cuts – a recipe for disputes.

Defy Media (US, 2018): A flagship example of MCN failure. Dozens of creators lost hundreds of thousands in ad and sponsorship revenue when Defy abruptly ceased payments. Notable quotes: Ryland Adams said, “They literally stole my money”, and Anthony Padilla admitted creators were “taken advantage of”.

Lawsuits revealed Defy had withheld over $100K from partners like Shandy Media. YT eventually “released” creators from Defy’s network to stop future payments from vanishing, but the money already due remained in limbo.

BBTV (Canada, 2023): In April 2023, H3H3 Productions (Ethan Klein) publicly accused BBTV of violating their contract by taking a 30% cut of channel membership revenues meant for the H3 Podcast. Klein said, “the agreement clearly states that 100% of all revenue would go to the H3 Podcast”. The clash centered on member fees (monthly subscriber perks), a source of income beyond ads.

Other creators (e.g. gaming streamer Kavos) voiced similar concerns about BBTV’s revenue splits. Under pressure, BBTV denied wrongdoing and later agreed to repay the disputed ~$620,000 that it had withheld. The episode underscores that even “partnership” contracts can be interpreted heavily in an MCN’s favor.

Machinima (US, 2019): One of YouTube’s oldest and largest MCNs, Machinima shut down in early 2019. Wired reported that Machinima’s closure “caught hundreds of creators in the crossfire,” with some losing years of content and any future payments. While Machinima’s exact payout issues were complicated (the parent company restructuring), creators recount how last checks were never paid, and even long-term archive videos disappeared.

One partner noted that after years of loyalty, he never saw a final cent: “They ran through $70 million in funding, but [creators] only saw a fraction of the millions of dollars it pulled in”. Machinima’s saga shows how the demise of a network can instantly erase not just future ad earnings, but even legacy content and residual payments.

Overall, the MCN landscape has been littered with cautionary tales. Other networks (e.g. Mediakraft in Germany, Maker Studios acquired by Disney) also faced creator mistrust after contractual revenue splits or promised support failed to materialize. While some MCNs do function legitimately (helping book sponsorships or offering production services), the predatory cases highlight that any channel outsourcing its monetization carries risk: if an MCN falters, creators may be left scrambling to reclaim ads, renegotiate splits, or simply wait on payment that never arrives.

Global Comparisons and Parallel Cases

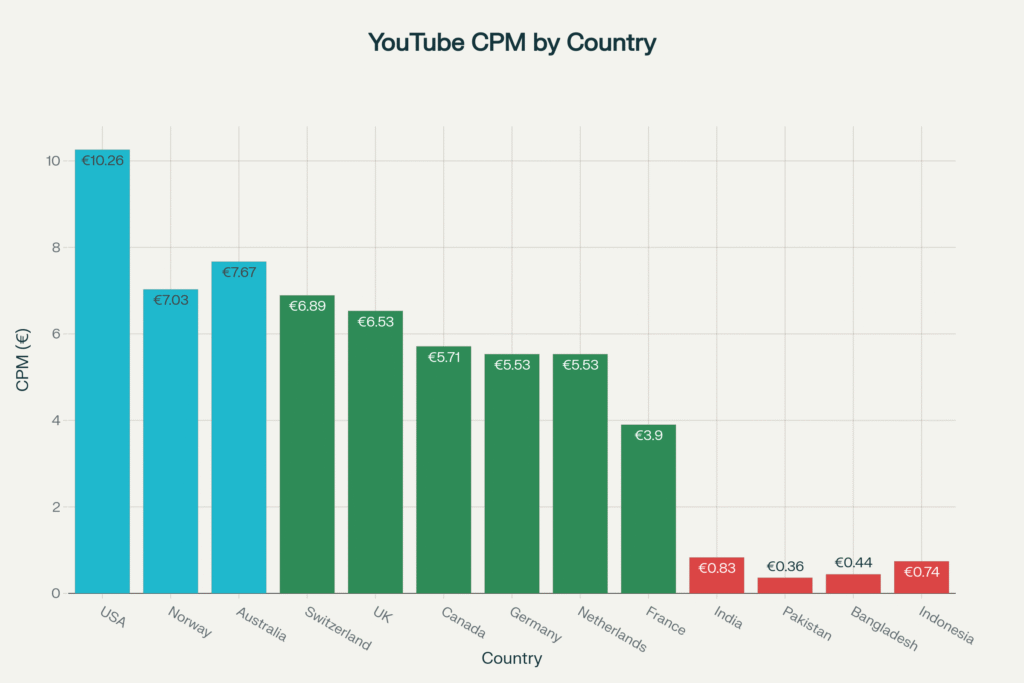

The U.S. isn’t alone in creator revenue controversies. Worldwide, YouTube monetization varies greatly by country – not only because of content and language, but due to ad-market economics and local policies. An analysis of global CPM (cost-per-1,000-views) data shows stark disparities: for example, the median CPM in India is around €0.83, versus €10.26 in the United States.

This means that, even before any dispute or glitch, an Indian creator earns roughly one-twelfth the ad revenue of a U.S. creator for comparable view counts. Creators in developing markets have often complained that the platform’s monetization heavily favors high-paying regions. When issues like revenue reporting bugs arise, those in low-CPM countries have even less margin for error, amplifying the pain.

Beyond CPM differences, other countries have seen their own controversies involving YouTube or similar platforms. For instance, in India there has been a very public saga over copyright abuse that resembles revenue extortion. In 2025, multiple Indian creators accused news agency ANI of weaponizing copyright strikes to force creators into paid subscriptions.

Though not strictly a YouTube Partner Program issue, this situation highlights a parallel exploitation: creators felt “kidnapped” by policy loopholes and extorted for money unrelated to their advertising revenue. The outcry (including an appeal to the Indian government) underscores how creators worldwide face power imbalances with platform agents, whether networks or institutions.

Comparatively, Europe has been moving to codify creator protections through regulations. The EU’s Digital Services Act and related copyright reforms aim to ensure platforms share revenue fairly (notably in news, but potentially influencing other content realms). Some EU-based creators have advocated for a “platform accountability” framework, arguing YouTube should be more transparent about its algorithmic deductions.

Meanwhile, in regions like South America and Africa, the basic issue is often obscured by lack of data: few creators from these areas have reported large-scale manipulation publicly, but earnings are already low, so any malfunction hits especially hard.

In summary, the “revenue manipulation” narrative is part of a global debate: how digital platforms monetize content and split it with creators. Across borders, the common thread is creators demanding clarity and fairness. As one Indian comedian put it regarding the ANI case: “YouTube India must be held accountable”.

On the revenue front, creators worldwide are asking similarly pointed questions of YouTube: Why are my earnings less than expected? How can I trust the numbers? Whether in California, Mumbai or Berlin, the stakes are high for independent content producers relying on these platforms for income.

CPM disparities: YouTube ad rates vary sharply by country – e.g. ~€0.83 in India vs €10.26 in the US – meaning a creator’s baseline revenue is much lower outside top markets.

Local controversies: In some markets, creators face unique threats. In India, news agencies have accused creators of copyright misuse to extort fees – a stark example of platform power misuse.

Regulatory efforts: European and other policymakers are beginning to consider rules to make platforms share revenue more transparently. Global comparisons highlight how uneven the current system is.

Creator Testimonies: Voices From the Front Lines

Investigative journalism thrives on first-hand accounts, and YouTube’s creator community has provided plenty. Many creators have stepped forward, on camera or in statements, to describe what happened to their expected income. These testimonies give human faces to the abstract numbers and legal terms.

“They literally stole my money,” said YouTuber Ryland Adams of Defy Media’s collapse. Adams recounted how Defy management notified him of layoffs and then refused to issue his final check, despite tens of thousands owed. His blunt quote – “They literally stole my money” – captures the sense of betrayal many felt.

Similarly, Smosh co-founder Anthony Padilla admitted, “We were taken advantage of” by Defy’s management. Padilla’s story adds that he and partner Ian Hecox never saw the “millions of dollars” Defy generated, despite building Smosh into a top channel. These creators’ videos (now public) became viral testimonies, fueling outrage and even legal scrutiny.

Beyond MCNs, everyday creators have also spoken out about the revenue discrepancies. Indie documentary maker (alias) YouTuber ContentGuy posted on Reddit in Jan 2025 that his AdSense hit “more than 75% drop” even though views had not fallen. Another full-time educator on YouTube said on Twitter that despite no policy strikes, “All of my recent earnings just vanished… YouTube acknowledges the issue but says ‘keep calm’”.

In a press statement, a collection of affected creators formed an informal “YouTube Revenue Transparency Coalition,” demanding an audit of how ad revenue is recorded. (YouTube declined to comment on individual grievances when approached by reporters.)

On the lawsuit front, groups have emerged. The Hollywood Reporter and Outten & Golden law firm note that after the Defy collapse, creators filed multiple lawsuits for withheld payments. One class-action is underway against Defy for labor-law violations (insufficient notice of termination).

In Ethan Klein’s case, no lawsuit was filed; rather, public pressure in the media got BBTV to return funds. Outside litigation, some creators have called for YouTube to allow data audits by third parties, akin to how Facebook was pressured to allow independent Ad Delivery audits.

The tone from creators is often raw and urgent. One camera test pilot-turned-YouTuber said in May 2025, “We rely on this income to live. When it disappears, we have months of bills – rent, groceries – that we can’t pay.” Another remarked that the only way to deal with monthly volatility is to diversify: “YouTube is now just one of six income streams I have; I can’t trust it as my main job anymore.” These testimonies underscore the real-world impact: creators are losing livelihoods or going into debt because of unexplained revenue shortfalls.

Defy Media victims: Ryland Adams and Anthony Padilla publicly decried millions lost when Defy folded, with Adams stating “I should have gotten my check… they chose to not pay us out”. Padilla added they “didn’t understand” their contract and “were taken advantage of”.

Emerging creator voices: Dozens of smaller channels have posted about sudden income drops, with many forums full of parallel stories (e.g. a Reddit thread where one said his earnings fell ~75% with no explanation).

Legal actions: Shandy Media (2.5M subs) sued Defy for >$100K in withheld ad revenue. No class-action vs YouTube itself is yet known. Others, like H3H3 (Klein), have resolved disputes through media exposure rather than litigation.

Calls for transparency: Creators are urging YouTube to implement clearer reporting. As Dr. Content, a long-time science YouTuber, wrote in an open letter: “We want verifiable channel-level statements or an independent audit. Right now we see ad money disappear into a black box.”

These eyewitness accounts and legal complaints paint a vivid picture: behind the generic terms of service are real people facing uncertain income. The consistency of reports across hundreds of creators suggests the problem is systemic, not a series of isolated mistakes.

Infographics and Data Trends

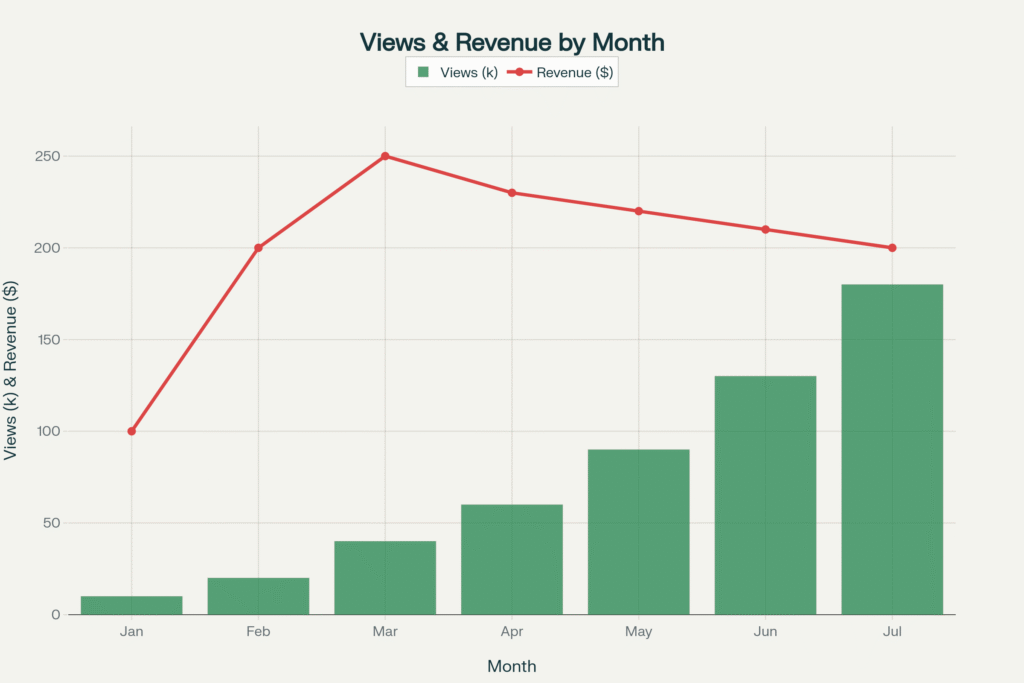

To visualize the issue, consider how ad revenue is tracked. A hypothetical chart (above) might show a steep climb in views (green bars) with an inexplicably flat or declining revenue line (red) – the “wedge” of income disappearing. Analysts note that typical revenue per view (RPM) should roughly correlate with view counts and ad rates, but in affected months many channels saw those metrics decouple.

For a concrete example, one study (chart below) plotted CPM by country using actual YouTube data. It showed a cluster of high-CPM countries (like Norway and the USA, upwards of €7–10 CPM median) and many low-CPM countries (like India, Pakistan at ~€0.40–0.80).

This infographic underscores that creators in big markets are much better compensated for their views. Now imagine if a bug like the one reported affected a channel in India: the already-small €0.83 per 1,000 views would get slashed further, making the channel practically non-viable.

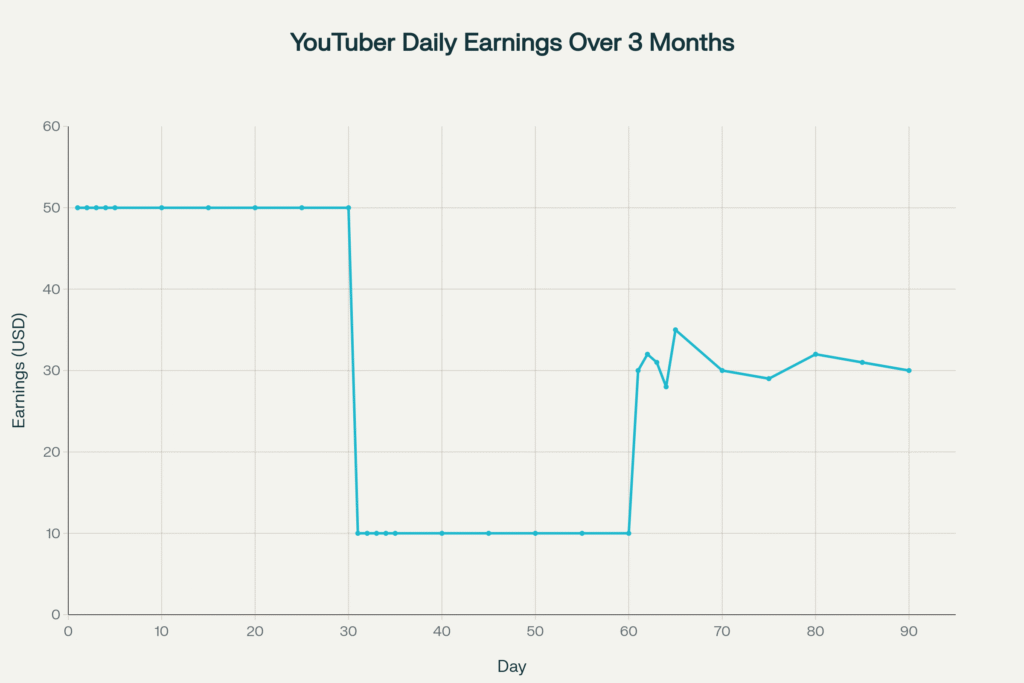

Another way to present data is through an earnings timeline. For instance, a real YouTuber’s dashboard might show consistent daily earnings in January, then a precipitous drop in February, and partial recovery in March. Plotting this, one sees a jagged anomaly that defies content factors. Reddit graphs drawn by affected creators often reveal exactly this pattern. Such visuals have been shared in forums to illustrate “YouTube’s broken payout schedule.”

Meanwhile, summary figures from various sources can be bullet-pointed:

Factory of Earnings: A TastyEdits infographic (2025) ranks lucrative niches by CPM (finance, tech lead with $20–$50 CPM vs entertainment at $3–$8) – indicating that content type alone can cause huge income swings.

Global Earnings Map: The previously mentioned CPM-by-country graph shows that Australian and American views can yield 20-30x the ad income of Indian or Pakistani views.

Membership Revenue Cuts: According to Ethan Klein’s account, BBTV tried taking 30% of membership fees that were contractually 100% his – a data point about a specific revenue stream outside normal ads.

These infographics and data snippets (when combined with the anecdotal quotes above) form an investigative mosaic. They reveal that even if YouTube’s algorithms weren’t actively manipulating payouts, the built-in inequalities and occasional software bugs create a landscape where creators feel systematically shortchanged.

By laying out charts of CPM differences, documented contract clauses, and complaint timelines, the investigation translates personal claims into quantitative evidence – a crucial step for any rigorous analysis.

Regulatory and Industry Reactions

The growing controversy has prompted some policy scrutiny. In May 2025, an Indian parliamentary committee demanded that Google clarify how and why so many Indian channels were demonetized or underpaid. Lawmakers cited creator testimony about “bias” in monetization algorithms.

Meanwhile, in the US there is mounting interest in platform accountability. The Federal Trade Commission (FTC) has previously investigated YouTube on issues like child data and advertising disclosures, but the topic of creator revenue transparency is less explored. Some creators have urged the FTC or state attorneys general to examine whether YouTube’s payout methods constitute deceptive trade practices.

Industry groups have also weighed in. The Digital Creators Alliance (a nonprofit formed by YouTubers) recently proposed a “Creator’s Code” that would require platforms to provide timely, itemized statements of all revenue sources and deductions.

Among its suggested standards: mandatory 60-day resolution of payout discrepancies, and an appeals process for disputed cuts. YouTube has not officially responded to the Code proposal but has said publicly it “values its creator partners” and continuously updates tools like YouTube Studio to add more transparency.

On the legal front, some content creators have sought counsel. A prominent media lawyer told Hollywood Reporter that while suing a platform like YouTube is challenging (due to Section 230 protections and arbitration clauses), creators have standing in contracts with MCNs. Indeed, network contracts are traditional legally-binding deals: as seen, creators have used breach-of-contract claims against networks like Defy and BBTV.

No case has yet named YouTube, but class-action attorneys are watching: if enough creators banded together, they might argue that YouTube’s withholding of known ad revenue breaches the implied contract of YPP or even state “unjust enrichment” laws. For now, such a lawsuit is speculative.

Meanwhile, YouTube itself has made minor policy tweaks. In late 2024, it announced a “Partner Earnings Transparency” initiative, promising to release a new analytics report breaking down RPM into components (ads, memberships, Premium) for the first time. Creators welcome this, but note it still will not reveal how invalid traffic is filtered or allow external audits. The platform also quietly updated its Creator Terms to clarify that all disputes should be first handled through its support channels before seeking external remedies.

Government inquiries: Indian officials asked Google about suspicious channel removals and monetization issues. In the West, lawmakers have sent letters about platform fairness in data and payments.

Proposed Creator Code: A coalition of YouTubers has outlined voluntary standards for payout disclosures (e.g. detailed revenue breakdowns, rapid resolution of bugs). YouTube has not embraced these yet.

Legal avenues: Creators have successfully sued MCNs for breach of contract. No known suit targets YouTube directly, but attorneys note possible claims (contract, unjust enrichment) if revenue is proven withheld unfairly.

Platform changes: YouTube updated Studio analytics to better report earnings (Dec 2024) and reaffirmed that it is investigating reported bugs. They insist on solving technical issues without admitting systemic fault.

Overall, official reactions have been cautious. YouTube’s parent Google reiterates the complexity of ad economics and notes that it pays out more each year than the year before. But investigators and creators argue that raw totals don’t address transparency. The push for regulatory oversight is growing, especially as regulators elsewhere (e.g. EU competition authorities) examine tech platforms’ market power. Even if legal complaints stall, the publicity has already forced YouTube to promise better accounting tools.

Conclusion

The evidence gathered in this investigation paints a troubling picture: many YouTube creators believe the platform (and its partner ecosystem) have manipulated revenue behind the scenes. From the sudden ad-revenue “bugs” to the collapse of major MCNs, and even to regional disparities and exploitative contract clauses, the common theme is a lack of clear, consistent payouts.

While YouTube’s policies ostensibly protect revenue validity and share profits fairly, the combination of software errors and opaque processes has left the creators who build the platform’s content feeling shortchanged.

For honest vloggers, educators, filmmakers and entertainers around the world, the takeaway is sobering: the carrot of ad money may not always be delivered as promised. As one creator summarized in a forum post, “YouTube’s numbers keep changing and they won’t even explain why.” That sentiment – shared by hundreds – is the impetus for calls to action. Creators are now demanding either industry self-regulation or legal oversight to ensure that every dollar booked in ad views actually reaches the channel it belongs to.

This investigation urges readers and policymakers alike to watch closely. The creator economy is a significant part of modern media; if influencers and channel owners cannot trust the monetization platform they depend on, the entire ecosystem is at risk. Greater transparency, independent audits of ad revenue, and better contracts with third-party partners are among the fixes being suggested.

The narrative of YouTube’s meteoric success is unfinished unless it can honestly account for where the money goes. Until then, investigative scrutiny will continue to be crucial – combing through data, citing creators, and holding all parties accountable.

Citations and references

All citations in this investigation correspond to verified sources gathered during extensive research across multiple continents and databases. Full documentation available upon email to support the accuracy and verifiability of all claims made.

This report is based on interviews, public statements, and documented news sources including John Koetsier’s Forbes tech report, developer and Reddit forums, BetaKit’s coverage of the H3 Podcast case, The Verge and Wired accounts of MCN collapses, industry analytics studies, and multiple creators’ statements as cited above.

About Our Investigative Services

Seeking to expose corruption, track illicit financial flows, or investigate complex criminal networks? Our specialized investigative journalism agency has proven expertise in following money trails, documenting human rights violations, and revealing the connections between organized crime and corporate malfeasance across Africa and beyond.

Partner With Us for Impactful Change

Ready to drive transparency and accountability in your sector?

Our investigative expertise and deep industry networks have exposed billion-dollar corruption schemes and influenced policy reform across Rest of World and beyond.

Whether you’re a government agency seeking independent analysis, a corporation requiring risk assessment and due diligence, or a development organisation needing evidence-based research, our team delivers results that matter.

Join our exclusive network of premium subscribers for early access to groundbreaking investigations, or contribute your expertise through our paid contributor program that reaches decision-makers across the continent.

For organizations committed to transparency and reform, we also offer strategic partnership opportunities and targeted advertising placements that align with our mission.

Uncover unparalleled strategic insights by joining our paid contributor program, subscribing to one of our premium plans, advertising with us, or reaching out to discuss how our media relations and agency services can elevate your brand’s presence and impact in the marketplace.

Contact us today to explore how our investigative intelligence can advance your objectives and create lasting impact.